Advertisement

Converting Boston’s offices to housing is tricky, but it’s starting to happen

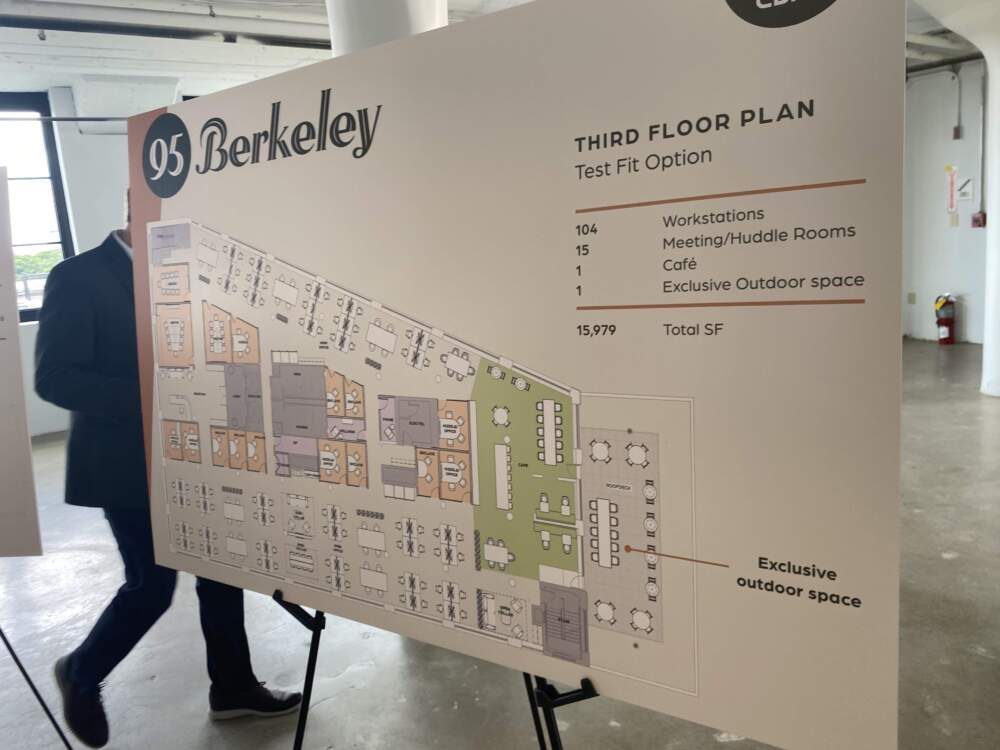

ResumeWhen Rich Kershaw’s company bought the building at 95 Berkeley St. in 2016, the plan was to renovate and rent out the offices.

“Upgrade the elevators, upgrade the bathrooms, redo the lobbies and the facade and hopefully increase the office rent per square foot,” said Kershaw, vice president of development at CIM Group, a Los Angeles-based real estate firm with $29 billion in assets.

They did the overhaul, but then the pandemic hit, and they could only land a tenant for one of the building’s six floors. Theirs is one of many commercial properties with persistent vacancies in the era of hybrid work, particularly at older buildings. Now the city and the state want to help transform these offices into housing.

“I don't see the office being a viable use for the near future,” Kershaw said. “So I think residential is perfect.”

Kershaw's company is set to convert the South End building into nearly 100 units of housing. It’s one of 13 office buildings — covering roughly 400,000 square feet — whose owners are exploring residential conversions with an assist from taxpayers. They could get a 75% break in property taxes from the city for nearly three decades, and $4 million from the state per project.

After a recent tour of 95 Berkeley, Boston Mayor Michelle Wu told reporters some owners have gone so long without business tenants for their buildings, they feel they have to look into residential housing.

“Finding any tenant would be easier and more cost-effective than ripping everything out and installing bathrooms in every unit,” Wu said, noting just part of a long list of changes needed to make a building fit for day-to-day living.

The push for office-to-residential conversions comes as officials look to address a number of problems that come with empty buildings: concerns about potential blight and keeping a vibrant downtown. And then there's Boston's pressing need for more housing.

There are also concerns on the part of building owners. Demand remains high for best-in-class office space in Boston — think of the gleaming towers in the Seaport — but for B and C-class offices, like many buildings around downtown Boston, the market is struggling. Office vacancies in the city have doubled since the first quarter of 2020, to 16.6%, according to CBRE research, and could continue to rise.

Advertisement

Advocates say conversions could kill two birds with one stone, warding off vacancies while adding desperately needed housing to the market. The state has set aside $15 million to subsidize projects in Boston, and a lot more is lined up in a housing bond bill now on Beacon Hill.

Cities across Massachusetts are identifying office buildings that could be candidates for residential conversions. Architect Tim Love of Utile Architecture and Planning, one of the contributors to Boston's conversion study, said certain features make buildings more adaptable. For example, he said commercial buildings built before World War II that rely on natural light and ventilation are more suitable for living than ones that came later, with massive floor plates and windows that don't open.

Beyond Boston, Love said, a number of Gateway Cities in Massachusetts have buildings that can be converted. And some of that work has already happened: consider the converted mills in cities like Lowell and New Bedford. The scale of this new crop of conversions may be smaller, but Love said repurposing even one underused building can help revitalize a neighborhood.

“Your downtown will be more successful if you've got more people living over the commercial space on the ground floors,” he said. “That is going to make your downtown more lively and less a place that goes completely quiet after 5 o'clock.”

Conversions alone can’t fix the problems of post-pandemic real estate, according to Greg Vasil, chief executive of the Greater Boston Real Estate Board. Vacancies have led valuations of some buildings to plummet by more than 50%, he said, and many financially troubled properties don’t fit the bill for conversion.

If the buildings can be used for residential apartments, owners could be in luck. “But is it going to move the needle and be the ultimate savior?” Vasil said. To him, that’s doubtful.

Asked if subsidizing conversions amounts to a bail-out for property owners, Paul Diego Craney, spokesman for the Massachusetts Fiscal Alliance, said developers need a hand to make certain projects feasible. Environmental regulations and affordable housing mandates can also drive up costs, he said.

“If you want these vacated spaces to become converted, you're going to have to make a deal sweeter for the developers, because no one can afford these new regulations and these taxes anymore,” he said.

That argument is not lost on conversion advocates. Love, the architect, said cities might consider waiving some requirements that are well-intended but make conversions untenable.

Correction: A previous version of this story incorrectly identified the neighborhood where 95 Berkeley St. is located. It is in the South End.

This segment aired on July 8, 2024.